GA Hard Money Lenders: Unlock Quick and Reliable Financing for Your Next Investment

GA Hard Money Lenders: Unlock Quick and Reliable Financing for Your Next Investment

Blog Article

The Ultimate Overview to Finding the most effective Tough Cash Lenders

Navigating the landscape of tough cash financing can be a complex venture, calling for a comprehensive understanding of the numerous elements that add to a successful loaning experience. From examining lenders' reputations to contrasting rate of interest rates and costs, each action plays an important role in safeguarding the very best terms possible. Establishing effective interaction and providing a well-structured business plan can significantly affect your interactions with lending institutions. As you take into consideration these aspects, it comes to be evident that the path to recognizing the best tough cash lending institution is not as uncomplicated as it may seem. What essential understandings could better boost your method?

Comprehending Hard Money Car Loans

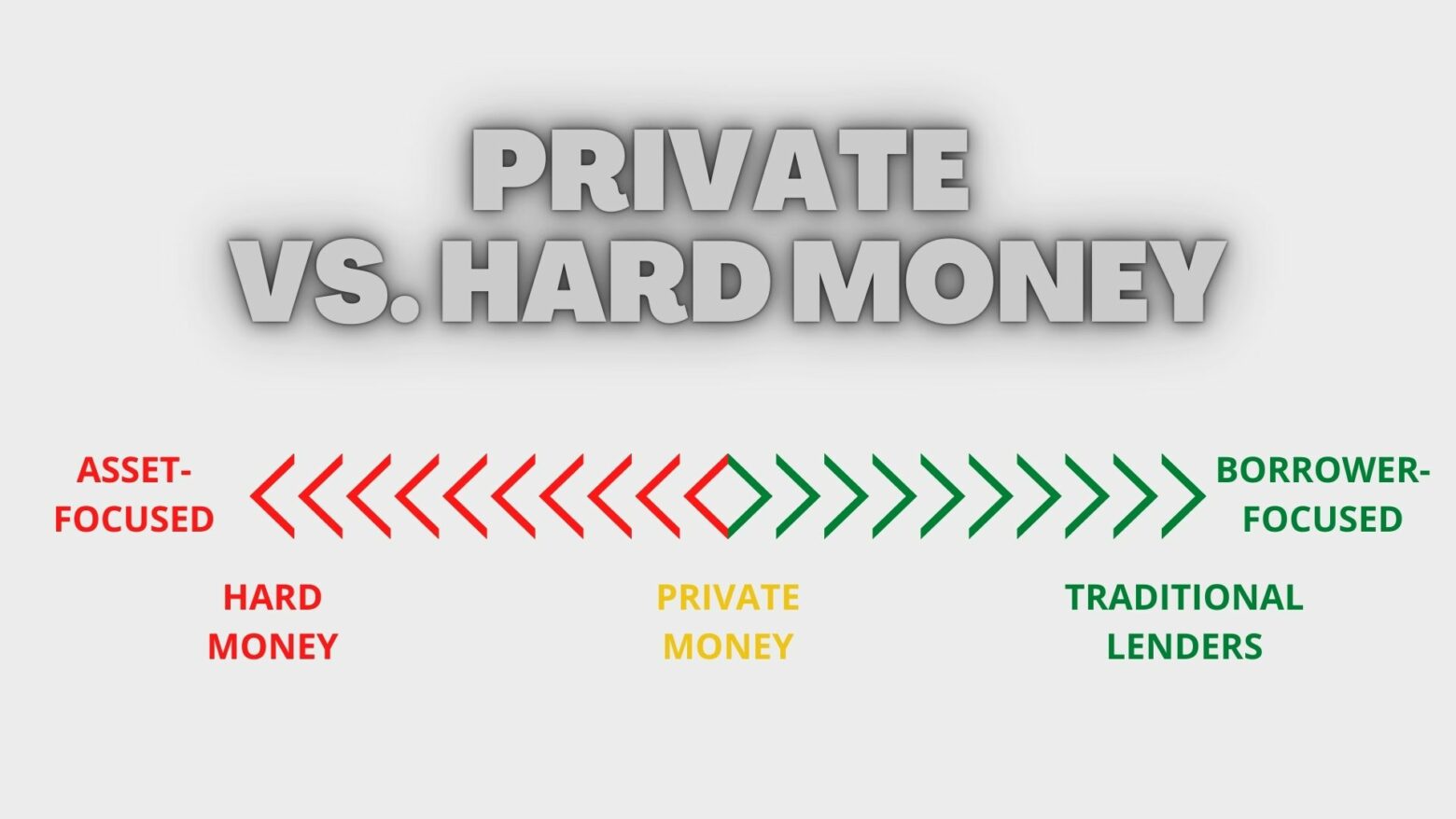

Comprehending difficult cash loans involves identifying their one-of-a-kind attributes and purposes within the realty financing landscape. These financings are typically safeguarded by real estate and are offered by private lenders or investment teams, differentiating them from traditional home loan items offered by financial institutions or debt unions. Hard money lendings are largely utilized for short-term financing needs, usually promoting quick purchases for genuine estate financiers or developers that need prompt funding for residential or commercial property acquisition or improvement.

Among the specifying attributes of hard cash financings is their dependence on the value of the building as opposed to the debtor's creditworthiness. This enables consumers with less-than-perfect credit or those looking for expedited financing to gain access to resources more readily. In addition, difficult cash financings generally come with higher rates of interest and much shorter settlement terms compared to traditional financings, showing the enhanced threat taken by lenders.

These car loans serve different objectives, including funding fix-and-flip projects, re-financing distressed buildings, or supplying capital for time-sensitive chances. Comprehending the nuances of tough money financings is important for financiers that aim to utilize these financial instruments successfully in their real estate endeavors - ga hard money lenders.

Trick Aspects to Take Into Consideration

When assessing tough money lenders, what crucial variables should be focused on to make certain a successful purchase? A trusted lending institution needs to have a tested track document of successful bargains and satisfied customers.

Following, take into consideration the regards to the loan. Different lenders offer differing rate of interest, fees, and payment timetables. It is vital to comprehend these terms totally to avoid any type of undesirable surprises later. In addition, take a look at the lender's funding speed; a quick authorization procedure can be essential in open markets.

Another important factor is the lending institution's experience in your details market. A lender acquainted with neighborhood conditions can supply beneficial understandings and could be much more adaptable in their underwriting process.

Just How to Examine Lenders

Evaluating hard cash lenders entails an organized technique to ensure you choose a companion that lines up with your investment objectives. A reputable loan provider should have a background of successful transactions and a solid network of pleased debtors.

Following, check out the lending institution's experience and field of expertise. Various lending institutions may focus on numerous sorts of properties, such as household, business, or fix-and-flip jobs. Select a loan provider whose know-how matches your financial investment method, as this understanding can dramatically impact the authorization process and terms.

An additional crucial variable is the lending institution's responsiveness and communication style. A reputable lending institution ought to be obtainable and ready to address your inquiries adequately. Clear communication during the examination procedure can show just how they will certainly handle your financing throughout its period.

Last but not least, make certain that the lending institution is clear about their requirements and processes. This includes a clear understanding of the documentation required, timelines, and any type of problems that might apply. Taking the time to evaluate these elements will empower you to make an informed decision when selecting a hard money lending institution.

Comparing Rate Of Interest and Costs

A complete contrast of rates of interest and fees among hard money loan providers is vital for optimizing your financial investment returns - ga hard money lenders. Difficult cash financings often feature greater rate of interest rates contrasted to conventional financing, typically ranging from 7% to 15%. Understanding these prices will aid you examine the potential expenses connected with your investment

In enhancement to rate of interest rates, it is important to examine the associated charges, which can dramatically impact the overall lending expense. These charges may include origination charges, underwriting charges, and closing costs, often expressed as a percentage of the loan quantity. As an example, source charges can differ from 1% to 3%, and some lenders might bill extra charges for processing or management jobs.

When contrasting loan providers, consider the complete expense of borrowing, which encompasses both the passion prices and charges. This all natural technique will permit you to determine one of the most economical alternatives. Be certain to make inquiries about any type of feasible prepayment penalties, as these can impact your capacity to pay off the lending early without incurring added costs. Eventually, a cautious evaluation of rates of interest and fees will cause even more enlightened borrowing decisions.

Tips for Successful Borrowing

Following, prepare an extensive organization strategy that details your job, anticipated timelines, and monetary estimates. This demonstrates to lending institutions that you have a well-thought-out technique, enhancing your trustworthiness. Furthermore, keeping a strong partnership with your lender can be useful; open interaction fosters count on and can result in extra positive terms.

It is additionally important to ensure that your residential property meets the loan provider's criteria. Conduct a complete assessment and provide all called for documents to streamline the authorization process. Lastly, bear in mind exit techniques to settle the car loan, as a clear repayment plan assures loan providers of your commitment.

Verdict

Furthermore, difficult cash lendings normally come with higher passion prices and shorter payment terms contrasted to standard finances, reflecting the increased danger taken by lenders.

When evaluating hard money lending institutions, what essential aspects should be focused on to ensure a successful deal?Examining hard money lenders entails an organized method to ensure you choose a partner that straightens with your financial investment objectives.A complete contrast of interest rates and costs amongst difficult money loan providers is necessary for optimizing your investment returns. ga hard money lenders.In recap, finding the best difficult cash lenders necessitates Visit Website a complete assessment of various elements, consisting of lending institution online reputation, financing terms, and field of expertise in building kinds

Report this page